Calculate social security wages on w2

With my Social Security you can verify your earnings get your Social Security Statement and. Instead it will estimate.

Pin By Connor Quigley On Connor S Tax Board Irs Tax Forms Social Security Internal Revenue Service

For security the Quick Calculator does not access your earnings record.

. You earned more than the Social Security wage cap in a given year. Convert the 62 percent Social Security withholding rate to a decimal by dividing 62 by 100 to get 0062. Instead it will estimate.

Box 1 reports your total taxable wages or salary for federal income tax purposes. Here is the formula for calculating taxable wages. Benefit estimates depend on your date of birth and on your earnings history.

The rate depends on several factors including your marital status the number of dependents pay frequency and gross income. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages The best payroll software. You do not owe social security taxes on any money above that amount.

The most common questions relate to why W. Subtract the non-taxable earnings found on the Wages tab as indicated below. The result is the taxable income.

Whats included in Medicare wages. However there is a maximum amount of wages that is. The best way to start planning for your future is by creating a my Social Security account online.

If you file your federal. Find the Gross Wages on the Wages tab. Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income.

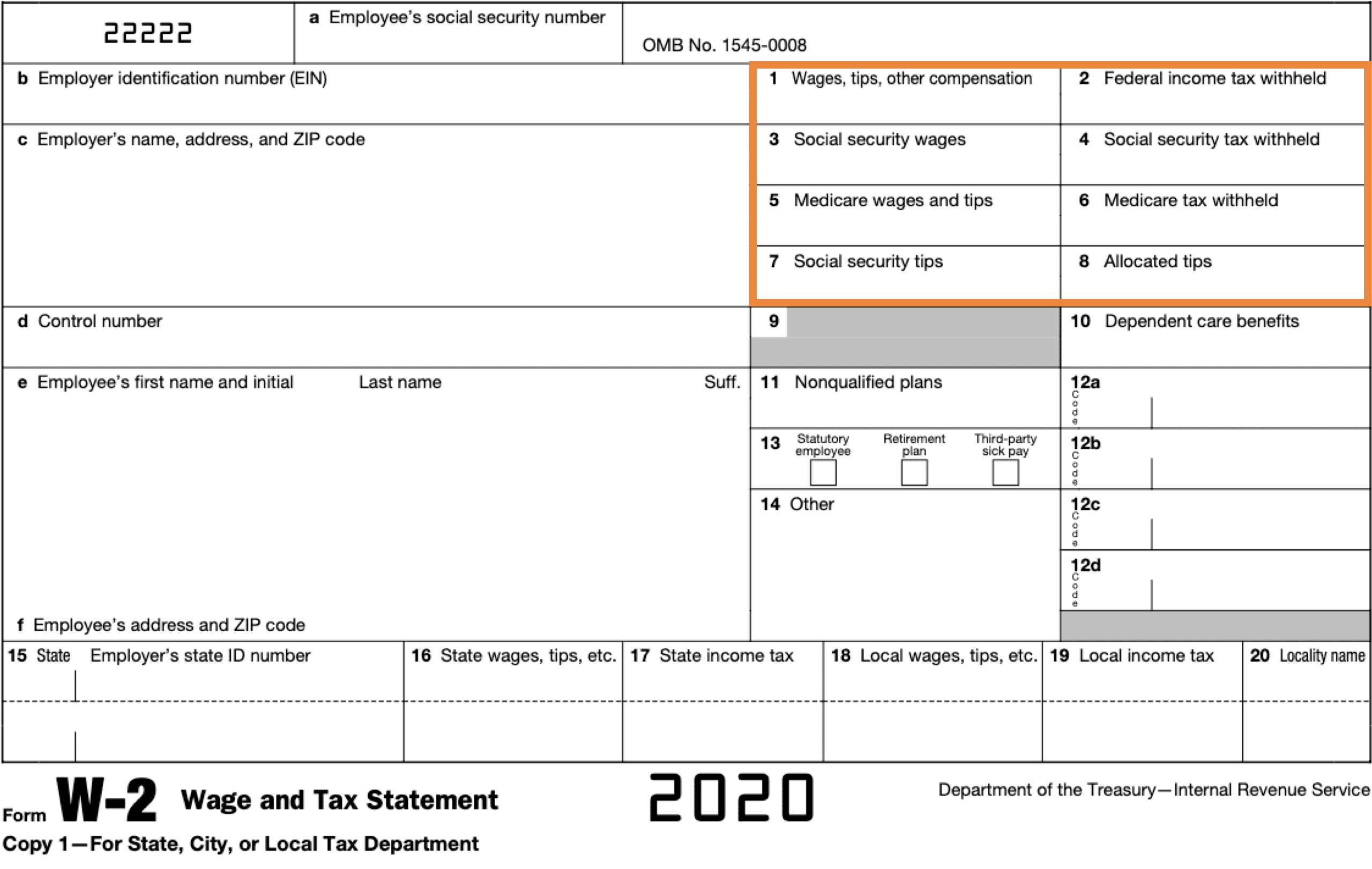

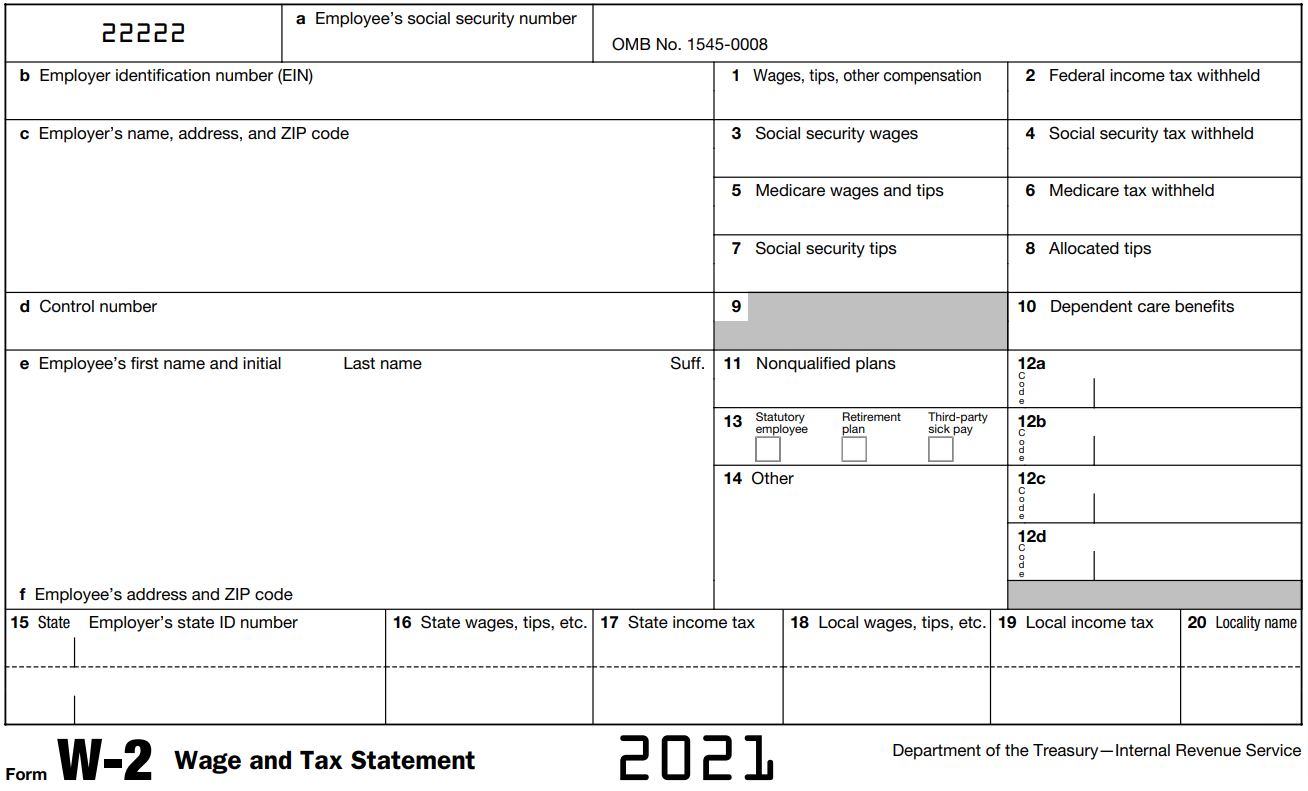

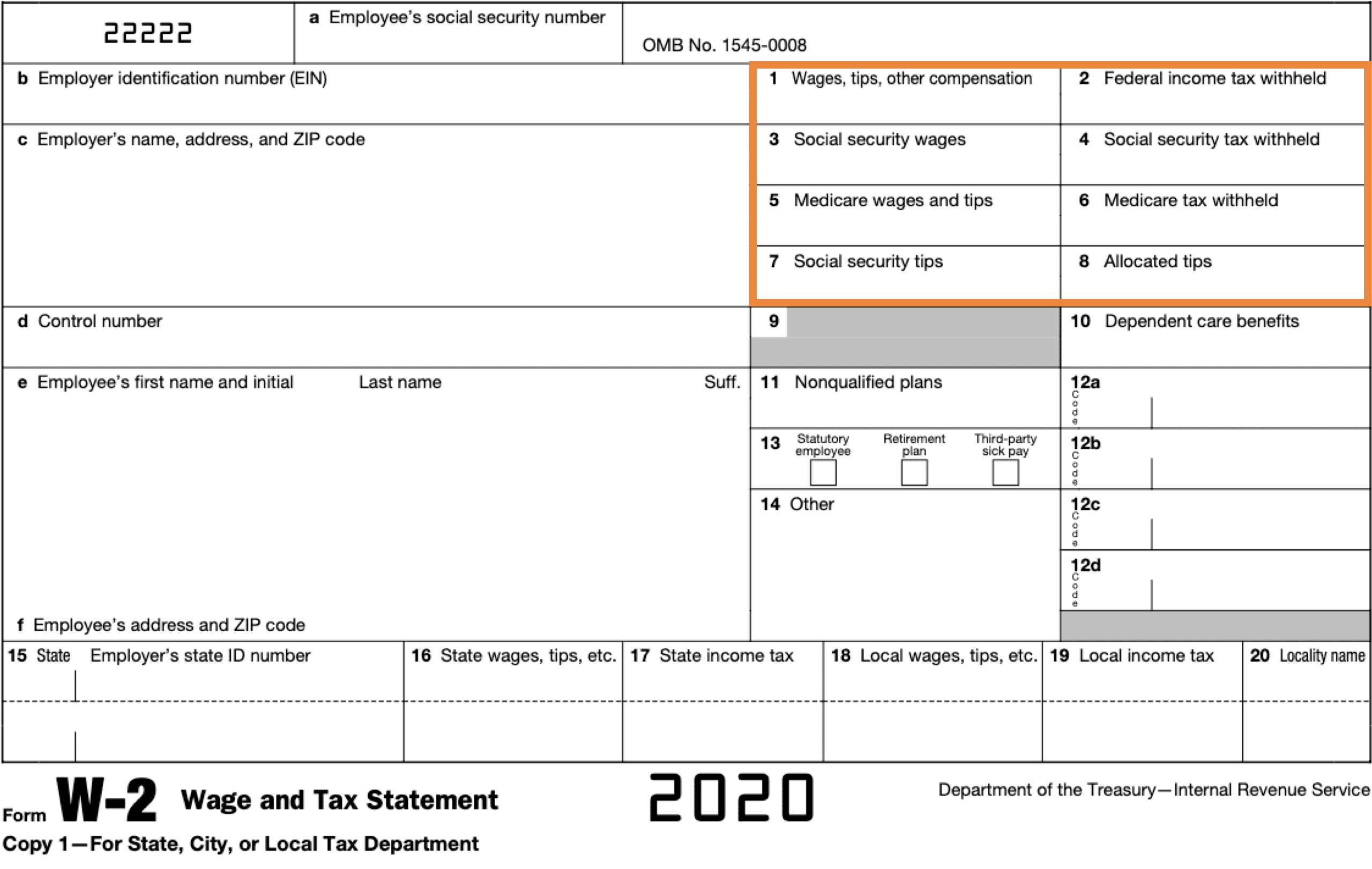

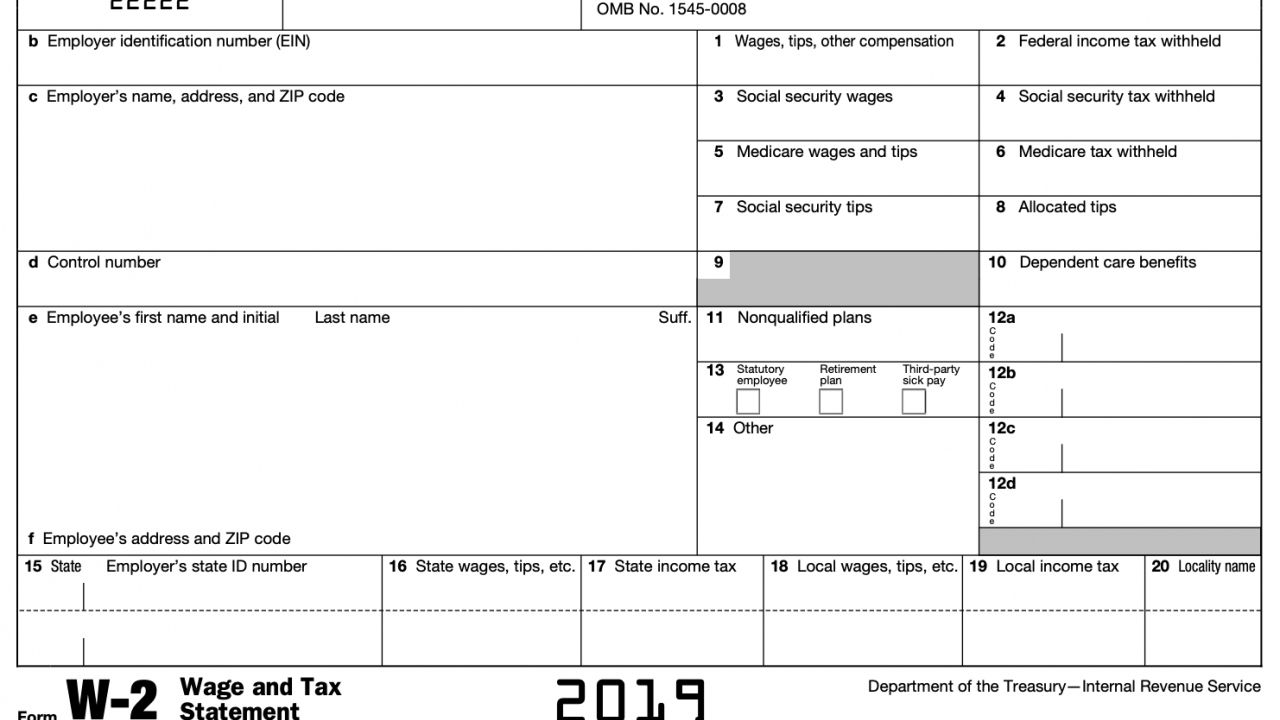

Benefit estimates depend on your date of birth and on your earnings history. Your employer gives Social Security a copy of your W-2 form to report. Most of these questions focus on understanding the amounts in the numbered boxes on the W-2.

Calculate Medicare and Social Security Taxable Wages. Payroll receives many questions about the W-2. Wages En español When you work as an employee your wages are generally covered by Social Security and Medicare.

Pay Summary Group Codes Transfer to the PR521. 2019 Tax tables are in Publication 15. In general Box 3 is calculated the same as Box 1 with a few exceptions.

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable. Box 3 represents the amount of social security wages that are subject to social security tax. For security the Quick Calculator does not access your earnings record.

Your combined income is calculated by adding your adjusted gross income nontaxable interest and one-half of your Social Security benefits. The number includes your wages salary tips you reported bonuses and other taxable compensation. In 2020 this amount is 137700.

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

How To Read A Form W 2

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Solved W2 Box 1 Not Calculating Correctly

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your W 2 Controller S Office

Understanding Your Forms W 2 Wage Tax Statement Tax Forms W2 Forms Power Of Attorney Form

Form W 2 Explained William Mary

Your W 2 Employees Help Center Home

2020 Tax And Payroll Updates Jan 18 Deadline For Electronic W 2s New W 4s And More Ucpath

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Irs Form W 2